[Read A Bit Blog] Wondering where the U.S. housing market is headed?

It’s the old supply-and-demand predicament: U.S. home sales continue at a rapid pace, but the number of listings remains limited. Amid historically low mortgage rates, buyers keep shopping, reducing inventory and sparking a rise in home prices.

Meanwhile, homebuilders have been coping with an increase in material costs and a shortage of labor, which is also contributing to the housing shortage. A National Association of Realtors study shows the U.S. has a deficit of about 2 million single-family homes and 3.5 million other housing units.¹

Five (5) factors that illustrate where the U.S. housing market is today and heading tomorrow.

ROCK-BOTTOM MORTGAGE RATES TO GRADUALLY RISE

Low interest rates continue to fuel demand from homebuyers. Some experts believe mortgage rates will creep up later this year, but they expect rates to remain near historic lows.2 In June, the Mortgage Bankers Association reported that 2020 closed with the average rate for a 30-year, fixed-rate mortgage at 2.8%. But the association anticipates the average rate climbing to 3.5% at the end of 2021 and 4.2% by the end of 2022.3

What does this mean for you? When mortgage rates are at or near historic lows (as they are today), you should seriously consider taking advantage of those rates to borrow money for a home purchase or to refinance your existing mortgage.

HOME PRICES EXPECTED TO KEEP CLIMBING

In June, the national median list price for a home reached an all-time high of $385,000, up 12.7% on a year-over-year basis.4 And according to the Home Buying Institute, various reports and forecasts indicate home prices will keep climbing throughout 2021 and into 2022.5 While this may be welcome news for homeowners, high prices are pushing homeownership out of reach for a growing number of first-time buyers.

What does this mean for you? If you’re a buyer waiting on the sidelines for prices to drop, you may want to reconsider. While the pace of appreciation should taper off, home prices are expected to continue climbing. And rising mortgage rates will make a home purchase even more costly.

SINGLE-FAMILY HOME SALES REMAIN ROBUST

Single-family home sales are down from their peak in October 2020 yet are still above the overall level last year. In May 2021, 5.8 million existing single-family homes were sold in the U.S. That’s a 45% increase over the 4 million homes sold in May 2020.6 Fannie Mae expects total homes sale to tick up slightly in the fourth quarter and finish the year up 3.8% over last year.6,7

What does this mean for you? If you’re a homeowner, you may want to ponder whether to sell now, even if you hadn’t necessarily been thinking about it. With demand high and inventory low, your home could fetch an eye-popping price.

LACK OF INVENTORY STILL CONSTRAINS THE HOME MARKET

According to the National Association of Realtors, in May there were 1.23 million previously owned homes on the market. This translates to a 2.5-month supply of homes, which is well below the 6 months of inventory typical in a balanced market.6,8 According to the Realtors group, the lack of inventory translates into tougher searches for buyers and contributes to a rise in prices.6

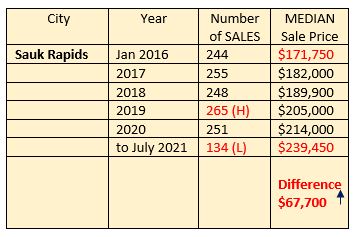

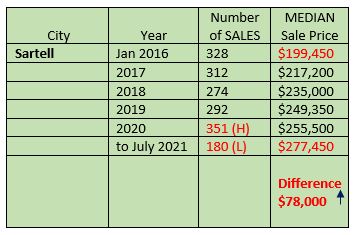

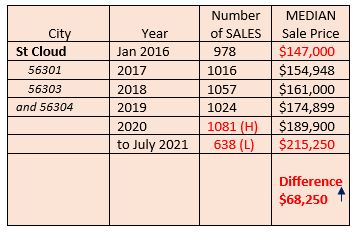

We’ve included a snapshot of what has been happening in our local market for the past 5 years.

The charts highlight the years with the highest number of home sales in Sauk Rapids, Sartell, and St Cloud compared to sales so far this year. We also wanted to give you an idea of the Median Sale Price in 2016 compared to what the median price is now in 2021.

5-Year Snapshot

of Our Local Market

January 2016 to July 2021

Single-Family Homes

What does this mean for you? If you’re thinking of selling your home, now may be the right time to do it. Across the country, it’s a seller’s market, meaning demand is outpacing supply. That supply-and-demand imbalance puts sellers in a great position to sell their homes at a premium price.

According to the National Association of Realtors, nearly half of homes are selling above the list price.9,10 We are seeing this in our local market, too

CONSTRUCTION OF SINGLE-FAMILY HOMES SEES SLIGHT UPTICK

Frustrated buyers may soon find some relief from an increase in new construction. Economists forecast that 1.1 million new houses will be started in 2021, compared with a predicted 940,000 units just six months ago, with 1.2 million new starts predicted for 2022 and 2023, according to the Urban Land Institute.11

What does this mean for you? Given the issues affecting the new-home market, it may make sense to widen your home search to include both new and existing homes. Your brand-new dream home may not be available, but you might be able to find an existing home that lives up to your vision. Keep in mind that we can help you find either a new or existing home and can advocate for you to ensure you get the best deal possible.

Sources: 1. Wall Street Journal 2. Time 3. Mortgage Bankers Association 4. Realtor.com 5. Home Buying Institute 6. National Association of Realtors

7. Fannie Mae 8. Real Estate Center at Texas A&M University 9. National Association of Realtors 10. Realtor magazine 11. Urban Land Magazine

ARE YOU THINKING OF BUYING OR SELLING?

If you’re in the market for a home, you’re ready to sell your house, or you’ve simply been wondering whether you should sell, you could benefit from an expert to help you in today’s real estate market. Let’s set up a free consultation to discuss your situation. We can review your options and come up with a plan to capitalize on the value of your current property or find your ideal next home.

![]()

New Century Real Estate is an energetic team that helps you fully understand the process of purchasing and/or selling a home. Be sure to ask us about savings available for local Hometown Heroes who buy or sell a home with a New Century Real Estate Agent.